How does Venmo make money? very common and good questions because Venmo is a free digital wallet and Venmo services are free then how does Venmo make money? To understand how Venmo makes money you have to understand the business model of Venmo and Venmo services details.

Introduction About Venmo

Venmo is one kind of free digital wallet that helps people to transfer money with each other and Venmo also offers payment services at some selected Marchant. With the help of Venmo users can make payments at some selected Marchant online or via debit card.

Venmo was first founded in 2009 and the headquartered in New York. After lunching of 2 to 3 years Venmo gains a lot of customers. In the year 2012 Venmo was acquired by Braintree for $26.2 million and a year later it was acquired by Paypal for $800 million.

About Venmo Services

Venmo offers different types of services as well as user activity through the app. For example, Venmo credit card, Venmo debit card, Venmo gift card, you can pay for the business, pay for different stores, and more.

Recently Venmo offers a business profile where you can create a business profile and you can accept payment for your business and accept for your store, create a business profile for your merchant account, and more facilities available.

How Does Venmo Make Money?

Venmo makes money through the Venmo different services. Venmo offers the service is totally free but Venmo creates a strong business model to make revenue from the Venmo app. There are many different ways are available by which Venmo makes money.

For example, make payment, cash exchange, interchange money, money withdrawal, affiliate marketing model, cash interest, cash a check, store payment for business, and more. Now discuss in detail how does Venmo makes money from the Venmo app.

Opening A Venmo Account

To use Venmo you have to open a Venmo account and the account opening is totally free for all but obviously, you have to stay in the US. Besides this, if you already hold a Venmo account then you don't have to pay any money for holding a Venmo account because Venmo is totally free and no monthly fees need.

Online Purchase

Venmo does not charge any fees when you purchase anything from online merchants. If you look into the Venmo fees page then you can see that they clearly define that there are no charges or fees for online purchases.

But there are some limitations on an online purchase like Venmo offers payment services for some selective online stores or selective companies. So when you are going to purchase then no fees are required for these selective stores or merchants.

But Venmo does not charge any fees for their users but when you purchase something then Venmo charges 2.9% fixed fees along with $0.30 per transaction. So here is Venmo income source. So you understand how does Venmo make money.

Send Money Using Credit Card

Venmo takes some charges when someone sends money through their credit card. They charge 3% fixed fees when you send money to anyone. Sending money using a credit card Is a great income source for Venmo.

Instant Transfer

From the year 2019 Venmo offer instant money transfer from Venmo account to the user bank account. In the past, it usually takes 2 to 3 days to transfer money from the Venmo account to the bank account.

For instant money transfers, Venmo charges 1% fees and the minimum fee is $0.25 while the maximum fee is $10 for instant money transfer. The instant money transfer from Venmo to Bank usually takes 30 minutes to credit.

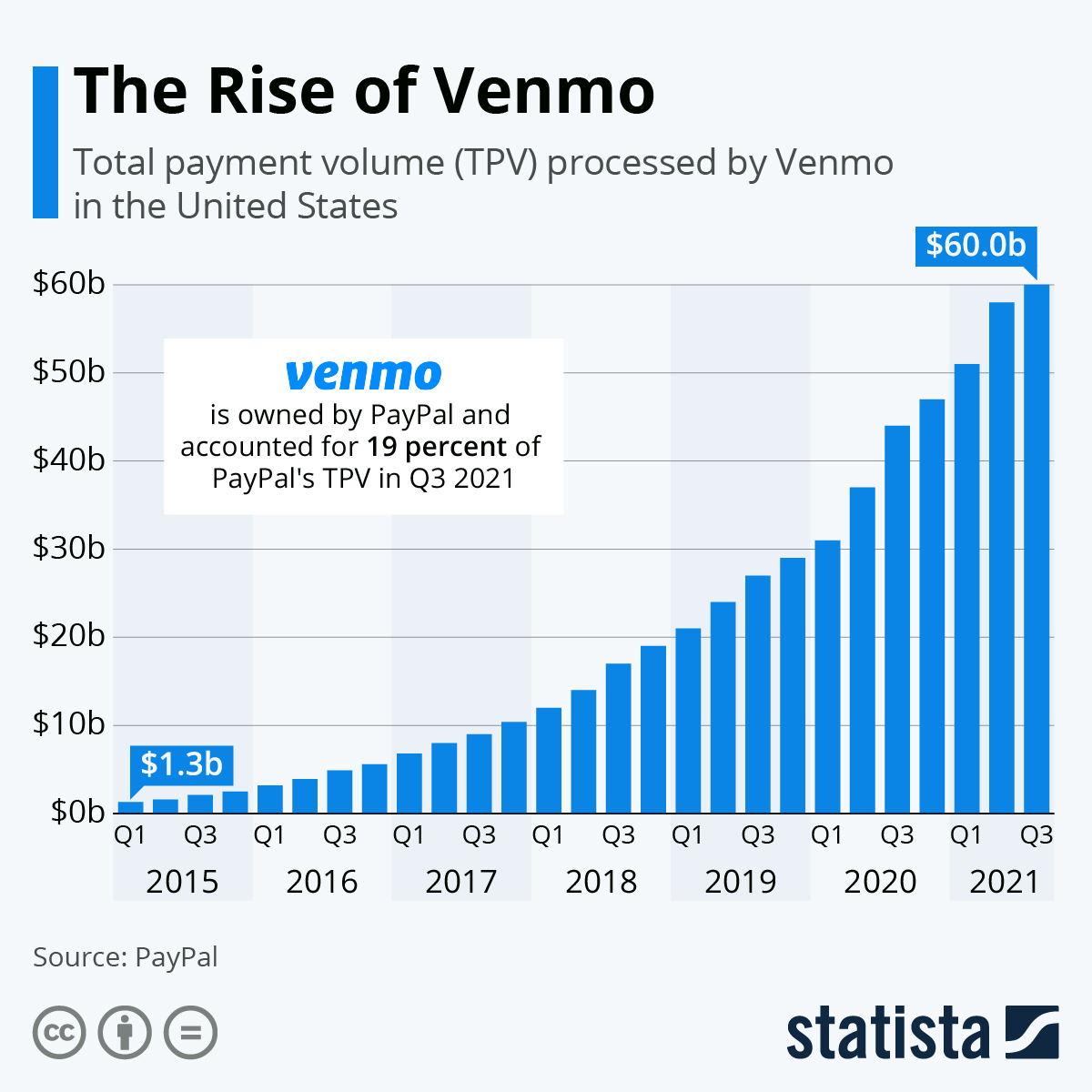

How Does Venmo Make Money | Venmo Rise Matric

How Does Venmo Make Money | Venmo Rise Matric Adding Money To Your Venmo Account

As I told you Venmo offers different types of options for adding money to your Venmo account. In some cases, Venmo does not charge any fees and in some cases, Venmo charges fees to add money to your account. I will tell you in detail

Transfer Money From Bank Account

If you add money from your bank account to your Venmo account then Venmo does charge any fees for that. But before that, you have to link your bank account to your Venmo app then no charges apply for adding money. So before adding money from the bank to Venmo you should link your bank account.

Receive Money From Other Venmo Users

If you want to add money by transferring from your friend's Venmo account or your friend sends money from their Venmo account to your Venmo account then no charges apply.

Receive From Marchant fund

No charges apply when your account is credited from a merchant fund that means if you purchase anything and use a Venmo account for payment purposes after that you refund the product then the Marchant also refunds your money to your Venmo account in that case no charges apply for that.

Add Money By Direct Deposit

If someone directly deposits money to your Venmo account then no charges or nor fees Is apply for that. Here it is not clearly defined by Venmo that the sender has to Venmo account or not.

Adding Money Through Cash Check (For Govt Check)

If you choose to deposit payroll or any government check which is pre-signed for money deposit then you have to pay 1.00% fees for that. The minimum fee is $5.00 and the maximum fee depends on the amount you deposit to your Venmo account.

Adding Money Through Cash Check (For Non-Govt Check)

If you want to add money through cash check features and if the check is a non-government check then you have to pay 5.00% fees that and the minimum fee is $5.00 and the maximum fee depends on what amount you want to deposit to your Venmo account. So from this point, you understand how does Venmo make money.

Receive Payment To Your Business Account

If you want to receive payment to your Business account then there is a seller transaction fee apply and the fee is 1.9% + $10 for each unique transaction you have done.

So here is a great source of income and I think you may understand how does Venmo make money.

Transfer Money From Venmo Account

There is a fee apply when you transfer money from Venmo to a Bank account. The current fee for transfer money from a Venmo account to a Bank account is 1.00%. The minimum fee is $0.25 and the maximum fee is $10.

Recently Venmo declares that from 2nd August 2021 the fee will be increased slightly from the previous that means the fee will be 1.5% and the minimum fee is $0.25 and the maximum fee is $10. So transfer money from your Venmo account to a Bank account is a point to understand how does Venmo make money.

You may also like: How To Enable Discord Push To Talk

Buying Or Selling Cryptocurrencies

Venmo recently starts cryptocurrencies features where you can buy and sell cryptocurrencies from your Venmo account. Some fees apply when you buy or sell cryptocurrencies I create a table in which you can understand the fees details for crypto.

| Cryptocurrencies Amount | Fees Details |

|---|---|

| Cryptocurrency purchase or sale amount $1.00 – $24.99 | $0.50 (Minimum Fee) |

| Cryptocurrency purchase or sale amount $25.00 – $100.00 | 2.3% of the amount |

| Cryptocurrency purchase or sale amount $100.01 – $200.00 | 2.00% of the amount |

| Cryptocurrency purchase or sale amount $200.01 – $1000.00 | 1.80% of the amount |

| Cryptocurrency purchase or sale amount $1000.00+ | 1.50% of the amount |

Use Of Venmo Mastercard

Venmo charges some percent of the fee when you use Venmo Mastercard for cash withdrawal purposes. Venmo charges a fixed fee which is $3.00 for each transaction you did for cash withdrawal from any bank or from any financial institution.

If you use your Venmo Master card for 2 times in a single day then you have to pay $3.00 X 2 = $6.00. It is a good income source. So you may understand how does Venmo make money.

Venmo Cashback Program

Venmo offers a cashback program when you buy something from an online store. In Venmo, you can find some selective merchants such as Chevron, Papa Johns, Target, and more.

The cashback program transfers a small amount of money to the customer account and Venmo makes a percentage of commission from the merchants.

Cash Interest

Venmo is just like the other normal Bank. Venmo uses the cash residing on its accounts to lend it out to other institutions, such as said banks, And then Venmo collects the interest from these institutions. It is also a good income source for Venmo.

The Final Word

Here in this article, I try to explain How Does Venmo Make Money? I include some of the income sources of Venmo. Maybe other income sources are also available. So if you think some income source of Venmo should be included in this article then please write in the comment box below.

Some Common Questions

Who pays the Venmo fee?

The fee is paid by the Marchants who accept the payment. The fee is $0.30 + 2.90% of total transactions.

What's the catch with Venmo?

No fee is required to send money from a Venmo balance, linked bank account, debit card.

How much does Venmo make a year?

Venmo makes millions of money from different income sources. In 2017 Venmo makes $160million, In 2018 Venmo makes $200Million, In the year 2019 Venmo makes $300 Million, and in the last year, 2020 Venmo makes $450Million revenue from the Venmo app.

If you want to know more about how does Venmo make money then check the article for more?

What is needed for a Venmo account?

Three main things you need you to create a Venmo account

No1. US resident,

No2. The valid US Mobile Number,

No3. The Valid US Document

Is it free to receive money on Venmo?

It is totally free to create a Venmo account. send and receive money from the Venmo app is completely free.